The Third Way To Pay

Alacriti offers three types of payments—one-time, recurring, and Pay By Text. If you’re a biller, you’re probably offering two ways for your customers to make payments:

- One-Time Payments: Customers have to remember to come to your website, call in, or mail a payment, each month after receiving a paper bill. You may also be sending them an electronic due date reminder, but they still have to take action by clicking a link and authenticating to make their monthly payment—unless you offer Magic Links, which allows for seamless payment without additional authentication.

- Recurring Payments: AKA Autopay or Direct Debit, when customers sign up to pay their bill each month and are automatically debited sometime after receiving a payment due reminder from you.

However, what about those customers who don’t like the automatically debited aspect of Recurring Payments and are busy or forgetful? What if they always end up making last-minute payments (or worse, late payments) each month?

Is there a different type of payment that could meet the needs of those customers? Well, there is, but first, we need to think about NACHA and payment authorizations.

NACHA & Standing Authorizations

The NACHA rules update in September 2021 defined a new payment authorization called a Standing Authorization:

“A Standing Authorization will be defined as an advance authorization by a consumer of future debits at various intervals. Under a Standing Authorization, future debits may be initiated by the consumer through some further action, as distinct from recurring entries which require no further action and occur at regular intervals.”

In other words, this allows us to capture an authorization like this from the customer:

“I pre-authorize you to use my payment method X to pay billed amount Y on my billing account Z at a future date once I approve that payment.”

All the customer has to do is say “Yes” to approve each payment. This then is what underpins Pay By Text.

Pay By Text – Set Up & Options

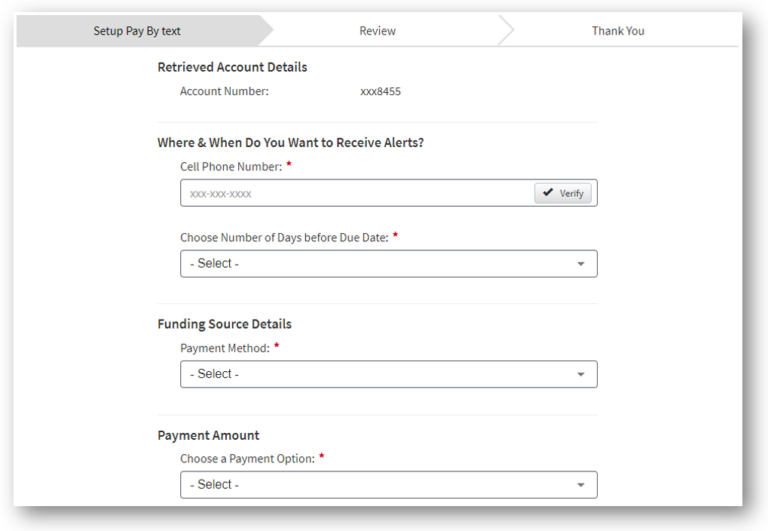

The customer must first set up Pay By Text through the Orbipay EBPP customer websites. They can do this through either the Guest or Enrolled sites. Below is what they need to select or enter:

- Cell Phone Number: The cell phone number where the customer wishes to receive Pay By Text alerts.

- Day Before Due Date: The option for the customer to receive the payment alert on the due date or up to 10 days prior.

- Payment Method: The Bank or Card Account that the customers want to use for making their payment.

- Payment Amount: The Billed Amount they want to pay.

They then review and agree to the Standing Authorization, after which we will set up Pay By Text on their billing account.

Pay By Text – Alerts & Payment Approval

Once Pay By Text is set up on a Billing Account, Orbipay EBPP will track that Due Date on the billing account.

On the Due Date, it will check the status of the billing account and whether an amount is still owed. If it is, it will send the Pay By Text Alert.

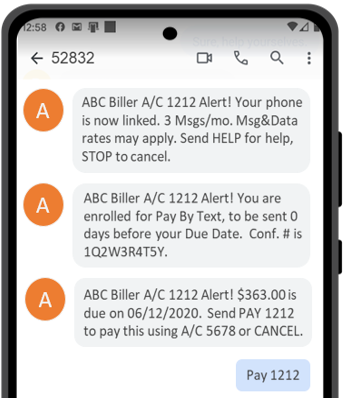

The alert will identify:

- The sender of the alert.

- The billing account it is for.

- The amount that is due.

- The due date of the payment.

- How to approve the payment.

- The payment method is to be debited.

- How to cancel the alert*

* Without explicit approval the payment cannot be processed, so customers can also ignore the alert and nothing will happen.

If the customer wants to approve the payment on their billing account ending 1212 they can simply reply ‘Pay 1212’ to the alert. Orbipay EBPP will then process a same-day, one-time payment and if it is approved it will send a confirmation via text.

In summary, Pay By Text provides those customers who don’t want to be automatically debited with a way to be reminded their payment is due and a way to approve their payment with one simple action.

Alacriti’s Orbipay EBPP is a customizable electronic billing and payments solution for businesses and financial institutions of all sizes. Orbipay EBPP offers convenient and flexible choices that include all the payment channels, payment methods, and payment options expected from a modern digital bill pay experience. For more information, please contact us at info@alacriti.com.