Solutions / Digital Disbursement

Solutions / Digital Disbursement

Digital Disbursement

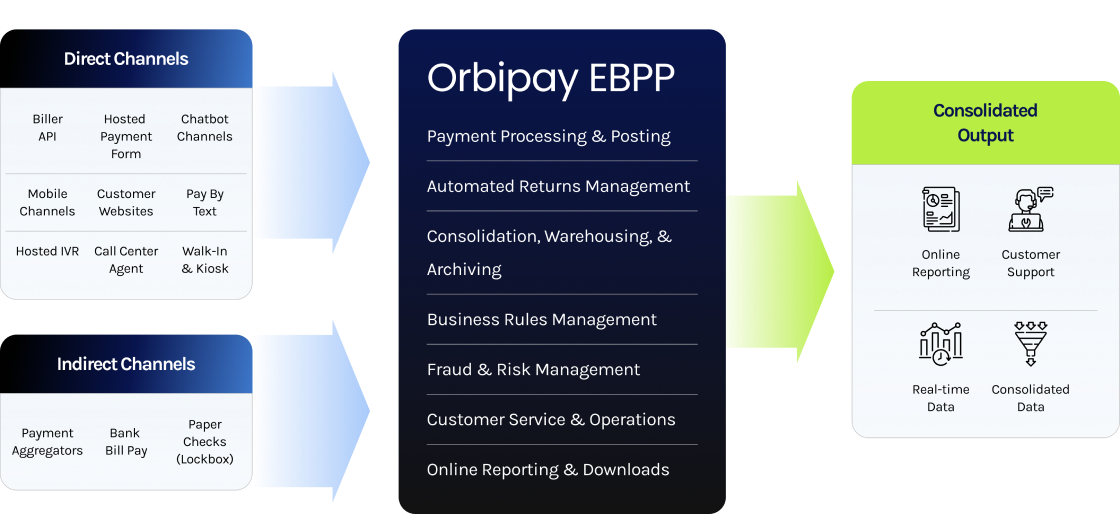

Highly scalable and designed for businesses and financial institutions of all sizes, Orbipay EBPP is a completely configurable cloud-based billing and payments solution that’s built to adapt quickly to the changing needs of your business, your systems, and your consumers.

“Since deploying EBPP for our loan payments, we've seen a reduction of calls to our call center by 61%.”

Boden Dullanty,

Digital Solutions Coordinator, Greater Nevada Credit Union

Deliver e-bills seamlessly and accept bill or loan payments from users with easy access to the payment channels, payment types, and payment methods they expect.

With more consumer options and better payment experiences, through a solution configured to your needs, you will see:

- ✓ Accelerated receivables

- ✓ Reduced operating costs

- ✓ Improved customer satisfaction and retention

Payment Channels

- Mobile

- Web

- IVR

- Agent

- Walk-In

- FB Messenger

Payment Methods

- ACH

- Credit (where permitted)

- Debit

- Cash

- Check

- Apple Pay/Google Pay

Payment Options

- One-Time

- Recurring

- AutoPay

All the channels you need in one platform

With our single, unified platform we offer consolidated services and features so that you can deliver exceptional payment experiences to your consumers.

Deliver a seamless experience

Ultimate Payment Flexibility

The Orbipay EBPP solution offers your customers the payment channels, payment methods, and payment options they demand.

Choose to pay via: Customer Portal; Pay-by-Text; AI Chatbot; IVR; Bank Kios; Agent Choose their payment method: ACH; Credit (where permitted); Debit; Cash; Check; Apple Pay/Google Pay

Choose their payment option: One-Time; Recurring; AutoPay

Unified Customer Experience

Our solution features a self-service and customer care portal that unifies the customer experience and consolidates customer service capabilities.

Customer Portal:

- Self-service functionality for one-time and enrolled payments.

- Schedule, manage, and view payments seamlessly.

- Customizable, reflecting your brand, and adaptable features

Customer Care:

- Consolidated view of all payments, regardless of the channel.

- Customer service capabilities include profile access, payment history review, and task execution.

- Efficient management of payments on behalf of customers.

- Accessible reports for informed decision-making.

Key benefits

Rapid Time to Market

Quickly deliver on customer expectations for convenient, real-time payment experiences. Gain access to critical clearing and settlement networks with pricing models that scale with you, eliminating the need for large upfront investments and allowing for rapid time-to-value.

A Modern & Future Proof User Experience

Offer new solutions to accelerate payments modernization and deliver intuitive, frictionless payment experiences to your customers or members, and give them more ways to pay—increasing satisfaction and retention.

Operational & Cost Efficiencies

Run your entire billing and payment operations on a single platform. Streamline workflows, automate manual processes, reduce overhead costs, and make better decisions with comprehensive reporting.

Security & Compliance

Built-in security features ensure data and privacy protection. Orbipay EBPP meets PCI DSS standards for payment card security and HIPAA compliance.

Case Study

Veridian

245%

Growth in RTP transactions

263%

Growth in RTP send

11

weeks – Time to deployment of solution