Electronic bill payments are only possible because of the payment methods that make digital fund transfers possible. The “big three” funding methods of electronic bill presentment and payments (EBPP) include credit cards, debit cards, and ACH transactions. While there are benefits associated with each of these payment methods, ACH dominates the transactions processed via Alacriti’s Orbipay® EBPP. In 2020, 68% of total transactions used ACH as their funding source, far outpacing debit card and credit card payments.

For those that might be unfamiliar with ACH, here’s a quick look at the basics of how it works and some of the attributes that make it a desirable choice for funding bill payments.

What is ACH?

ACH stands for the Automated Clearing House network, which moves information and money electronically between U.S. bank accounts. The network is a batch processing system that supports two types of transactions, Direct Deposit and Direct Payment. For example, Direct Deposit of paychecks from employer to employee are typically executed using ACH when the employee authorizes these transactions and provides their bank account information to their employer. Direct Payments are popular for making bill payments, both one-time and recurring because customers can automate their payments and reduce the likelihood of missing a due date.

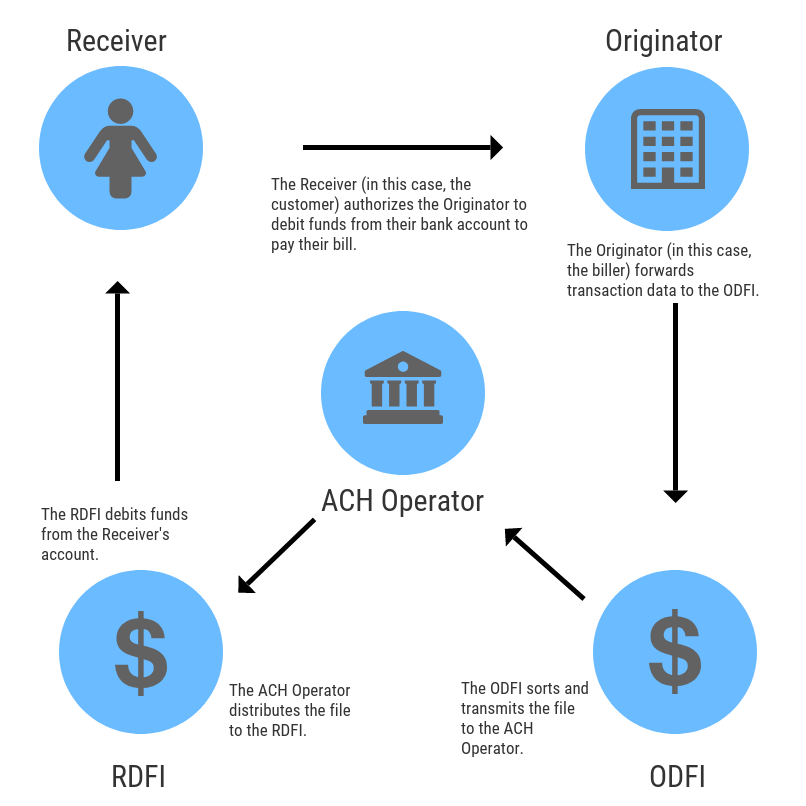

Which entities participate in ACH transactions?

ACH transactions require cooperation across several different entities. Here are the key players.

Originator

An Originator is a company, consumer, or organization that is authorized to initiate ACH entries (both credits and debits) into the payment system. These entries can initiate once an arrangement is in place between the Originator and the Receiver. In the case of Direct Deposit, the Originator would be the employer that is transferring payroll funds to an employee. In the case of a bill payment, the Originator would be the biller that is requesting funds from their customer.

Originating Depository Financial Institution (ODFI)

The ODFI is the financial institution that receives payment instructions from the Originator and forwards the entries to the ACH Operator.

ACH Operator

The ACH Operator acts as a central clearing facility that works on behalf of the DFIs, both Originating and Receiving. It receives batches of ACH entries from the ODFI and then sorts and distributes those entries to the appropriate RDFIs. There are currently two ACH Operators, The Federal Reserve, and The Clearing House.

Receiving Depository Financial Institution (RDFI)

The RDFI is the financial institution that receives ACH entries from the ACH Operator and posts the entries to the accounts of its Receivers.

Receiver

A Receiver is a company or consumer that authorized an Originator to initiate an ACH entry (credit or debit) into their account via the RDFI.

How does an ACH transaction work?

The workflow below illustrates the progression of an ACH transaction for a customer bill payment.

The Bottom Line: The ACH network is an integral player in money movement throughout the U.S. ACH is often chosen for bill payments because customers can authorize direct debits of their bank accounts and automate future transactions, reducing the likelihood of missed bill payments.

Learn statistics about ACH usage in our 2020 Trends Report.

*This is an update on an original post published April 2019

Today’s legacy and siloed banking technology infrastructure limit financial institutions’ ability to rapidly innovate. It’s time to look at money movement in a new way. Alacriti’s Orbipay Unified Money Movement Services does just that. Whether it’s real-time payments, digital disbursements, or bill pay, our cloud-based platform enables banks and credit unions to quickly and seamlessly deliver modern digital payments and money movement experiences. To speak to an Alacriti payments expert, please call us at (908) 791-2916 or email info@alacriti.com.