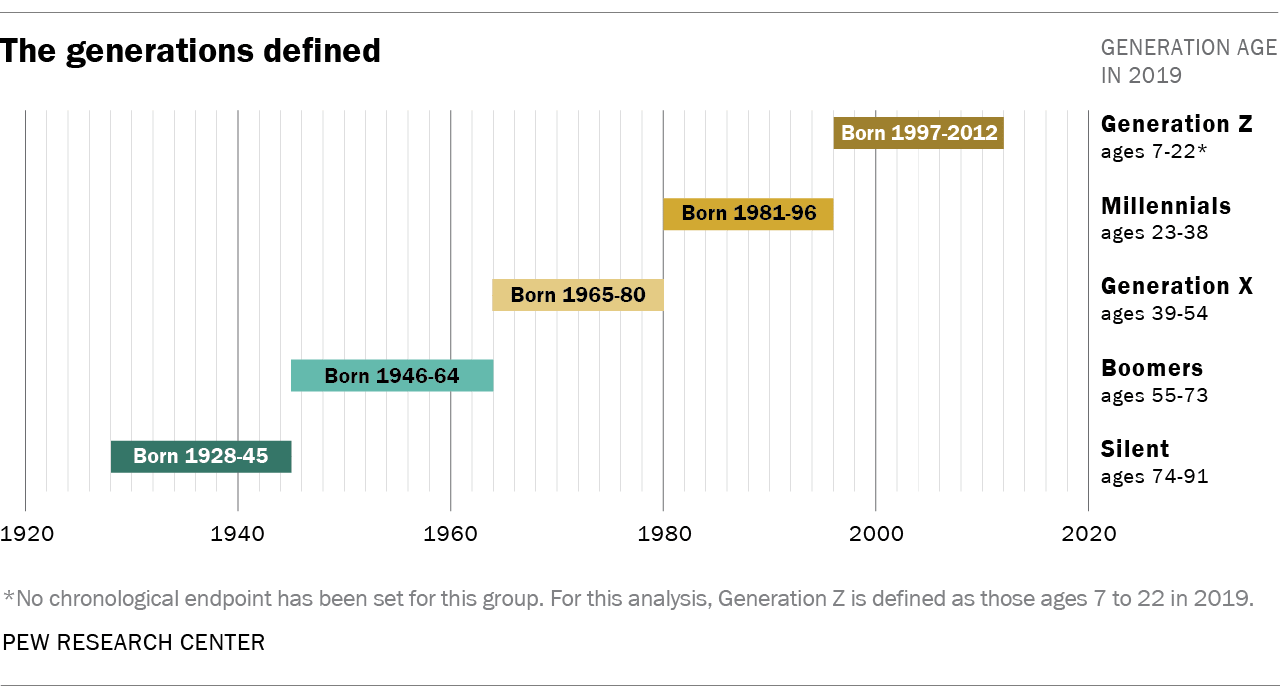

Zoomers, also known as Gen Z, are the “Digital Natives,” making up 32% of the U.S. population as of May of 2020. First, let’s talk about what the name Zoomer actually means. Zoomers are those born in the late 1990s and early 2000s, They are in the 9-24 year-old range, and they immediately follow millennials. Zoomers often joke about having nothing to lose, hence the unfortunate fact that a portion of them carry an exceeding amount of student debt. About 20% of Zoomers say they are indebted. As a Zoomer myself, I can say that student debt is something that is more impactful than I had ever thought it could be.

As a refresher, here is an overview of the generations:

Source: Pew Research Center

To gain an overview of the qualities that make up Zoomers, let’s start by diving into how community-minded they are. Standing up for communities and their betterment and fighting for a cause that is important to them is common for Zoomers. With their shared interest in the common good, credit unions and community banks are well poised to relate to Zoomers. They not only stand for communities but they also offer better rates. They essentially encourage members to save money, which, later in this blog, you will see how that resonates with Zoomers. Since they are nonprofit cooperatives, they often give out lower rates as well, which is, of course, attractive to a generation already in debt

According to Ben Rinshall, author of “How Credit Unions Can Connect with Gen Z, “Zoomers are likely to pay more if they really have to. What I mean by that is, if paying for a service will make their experience faster, they would not mind doing so.”

As per an article from last year, “Sustainable Retail: How Gen Z is Leading The Pack”, Gen Z, also known as Zoomers, are more likely to spend money on sustainable products, along with being more eco-friendly. About 59% of Zoomers buy upcycled products.

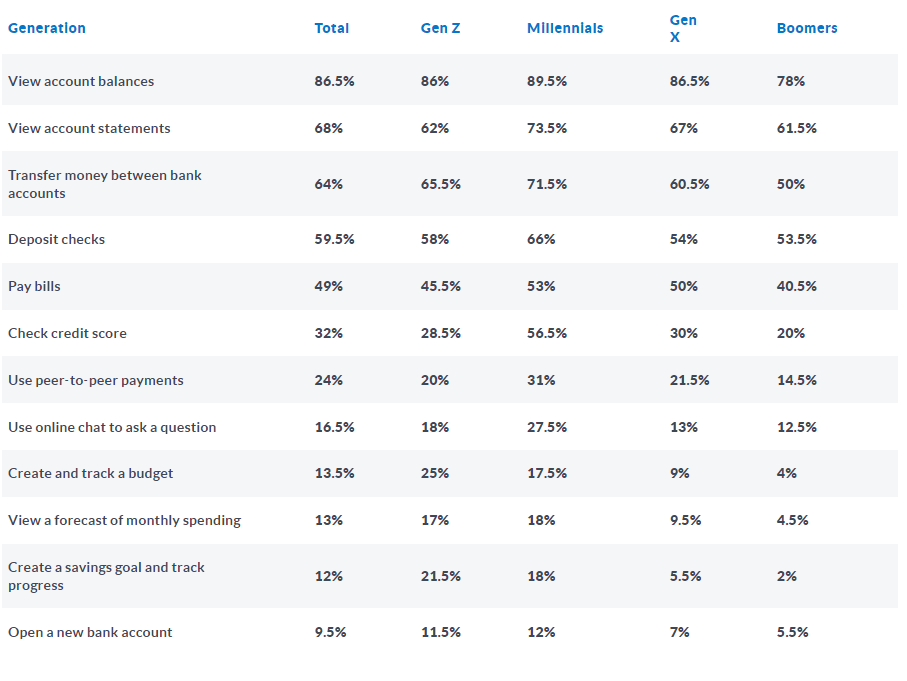

Zoomers are also known to be one of the largest groups that use digital banking apps. A study found that 99% of Zoomers use mobile banking apps. Digital banking, as we all know, is extremely popular. It is also very fast and efficient, which is important to Zoomers because they value speed. Since larger banks typically have bigger budgets for the latest technology, this is a potential advantage when it comes to targeting Zoomers.

If something is fast and efficient, they like it. If it’s not, they will most likely find something else that is. Having technology at their fingertips, it is easy for them to Google just about anything. When it comes to a website being too slow, they will quickly find something similar or better. Along with this, Twitter now has become a huge platform where you’ll find Zoomers giving reviews about anything and everything. That said, if a service or company is causing them to delay with their long wait times and other inconveniences, chances are a Zoomer will tweet about it. Zoomers, although easygoing and community-oriented, are also very fast-paced and even stern at times.

Making things easier and to the point, for Zoomers, is expected. Eliminating unnecessary steps in a process will make things easier to understand and, of course, make things faster. Making videos or “simple walk-through videos for [the] most complex operations” will attract more Zoomers. This same article uses Apple as an example of a website that makes things much easier to navigate, which in turn makes the user experience much better.

Aside from speed and efficiency, Zoomers also expect much more in the sense that they want clear communication and a good understanding of what they are doing. Whether it be the first day of work or just any other given task, 45% expect hands-on training, and 33% expect to know everything about their job on the first day.

By being aware of qualities like these in Zoomers, banks and credit unions can attract their Zoomer audience in a more targeted way. Think about the products and services that you offer that would be more appealing to this audience. Keep speed and efficiency as a high priority. If you lack in that area, they may turn elsewhere.