How quickly can humans adapt to technology changes? Many of us have pondered this exact question in some form over the years as we’ve watched technology advances take off. However, this question seems especially relevant now.

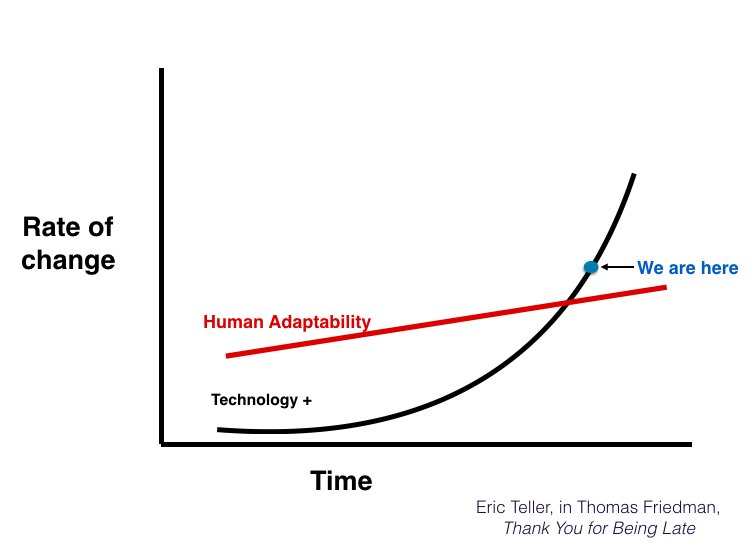

In Thomas Friedman’s book, Thank You for Being Late, the author goes into significant detail on consumers’ (or Humans as Eric Teller calls us in his graph) ability to adapt to their environments. As you can see below, it’s a slow and steady line.

Source: @GrantLichtman (2017, February 9). Retrieved from Twitter.

He then overlaid the graph with technology and how it has been accelerating over time, rather slow and multigenerational at first, and then taking on Moore’s law doubling in speed every two years. The point of the graph is to show that while humans were able to adapt to change when it was at or below our adaptability line, we have now entered into a fairly large disconnect between the two.

This idea is especially resonant when thinking about the effects that COVID-19 will have on consumer behavior. It is apparent that human behavior has already changed, and trends that we’ve seen around contactless payments and digital commerce have gone into hyperdrive. The fundamental idea of adaptability and the curve that Friedman has in his book is a unique perspective for these changes. The adaptability line that Teller presents doesn’t take into account watershed moments, where the line breaks and a new one takes its place.

When the world more or less came to a halt in March 2020, our line of adaptability broke. We now find ourselves FORCED toward new technology or things that make our existence as humans safer. The data is backing this idea up, and we are seeing a mass-market movement towards newer technologies (e.g. contactless payments, mobile payments, e-commerce) and that demand is pushing more innovation.

Some recent developments:

- With stores closing, brands that used to sell to stores are selling directly to consumers online. For instance, Heinz to Home and Snacks.com.

- When COVID-19 became a pandemic, there was a 44% increase in the use of contactless payments with some businesses displaying “card only” signs and refusing cash.

- As of July, there has been a 40% drop in ATM usage. People are both choosing not to use cash and a lot of stores are not accepting it

- Sales by consumers using mobile wallets for debit transactions increased by 76.6% in August compared to the same period last year.

Breaking old habits is hard to do, and as Teller’s graph shows us, it is partly due to our inability to adapt. As the famous saying goes, “If it ain’t broke, why fix it.” Well, here we are at a break, and consumers are and will continue to adapt to their new normal. The trends that were slowly burning in the background for the past ten years are all accelerating. It is now necessary to adapt your digital strategy to take this break in human adaptability into account and accelerate your go-to-market strategy. Modern channels like Facebook Messenger and Amazon Alexa that were once thought of as nice to haves are on the path to becoming need to haves.

Are you up to the challenge?