What is your API strategy? It’s a common question that we talk about regularly in the market, but what sounds like a fairly simple question can quickly turn into a very technical and detailed discussion. With microservices and APIs being at the forefront of payments digital acceleration, it’s important to fully understand what they actually deliver. In order to cut through some of the confusion that can be associated with the subject of API strategy, it would be prudent to break down the topic into some consumable (you may say micro) bytes.

First, let’s discuss microservices. Microservices are really just a set of fine-grain operations—instructions for software to do something. And what is an API? Well, I’m glad you asked. An Application Programming Interface (API) is a technical construct that enables software to talk to one another. If APIs are the glue, the microservices are what the glue is attaching to. And by the way, a recent study by Cornerstone Advisors showed that 53% of financial institutions have already deployed APIs, and 24% planned to invest and/or implement in 2021.

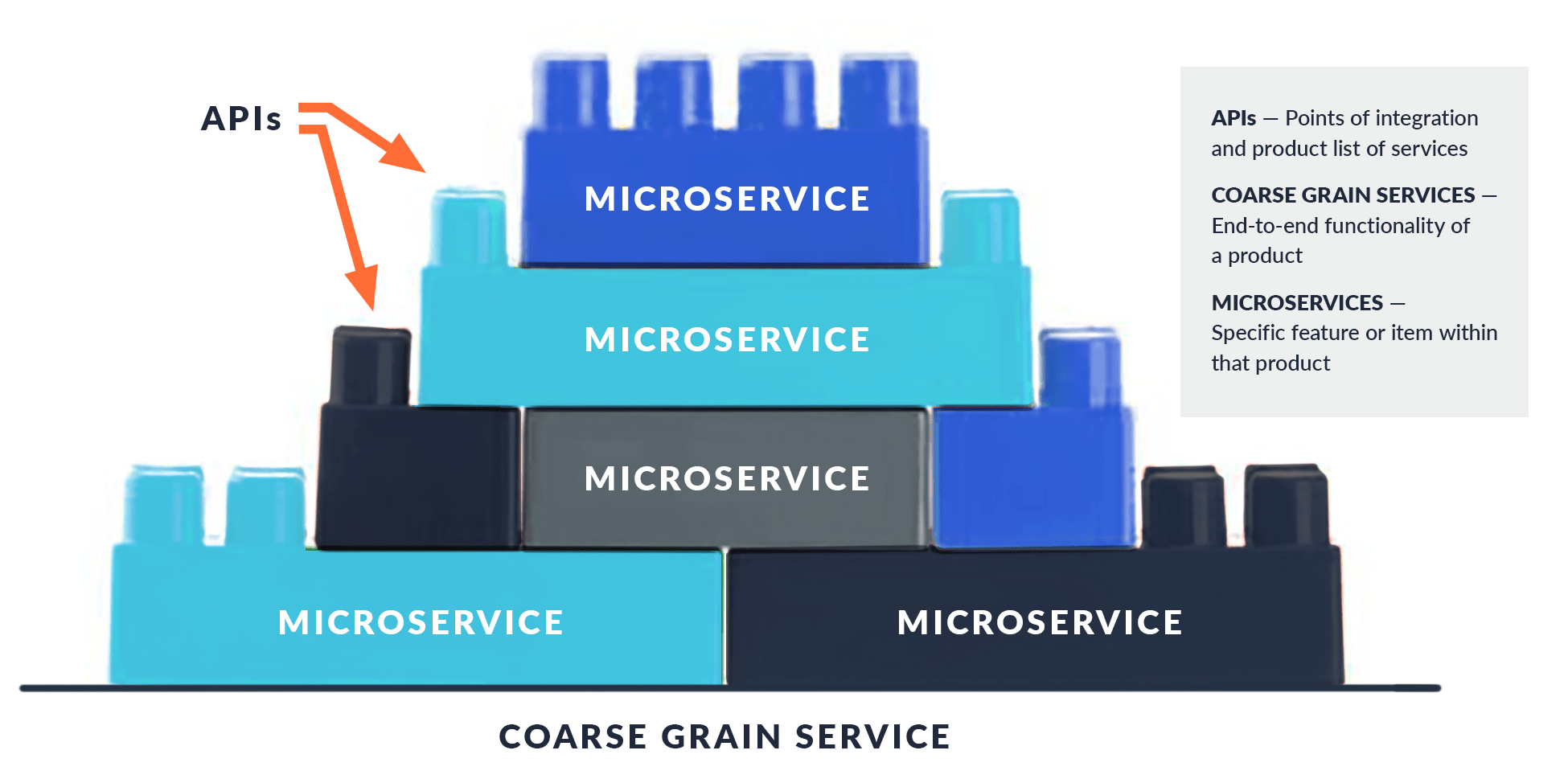

If you want to think of this in a hierarchy, APIs would be at the top of the list, which is a catch-all for both points of integration as well as a product’s list of services. Following that, you would have ‘coarse grain services’, which get you full end-to-end functionality of a product. You can think of this as a form sheet that would have: name, house number, street address, town, state, and zip. With the coarse grain service of a customer mailing address, the API strings together a bunch of microservices delivered in one payload of code. The third level down, you would have microservices that get you a specific feature or item within that product. Using the above example, it would be just “name” or “street”.

The key factor in a modern architected solution is being able to get down to microservices, and leveraging those instructions in larger workflows. An API strategy allows ecosystem participants to easily connect. Even better—a full API strategy that focuses on microservice-based architecture and enables the ability to build workflows and new solutions that take the best available ‘service’ rather than having to get everything from one provider. That’s what we mean when we talk about a holistic API strategy and one that will unlock the true potential of digital acceleration!

Alacriti offers an API First and Microservices based architecture on a cloud-based platform, Orbipay, with solutions for real-time payments, EBPP, and digital disbursements. This provides a flexible integration framework to enable easy integration with internal systems (core banking, fraud, risk management, etc.), and your organization can easily add support for new payment schemes as they become available.

To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com.