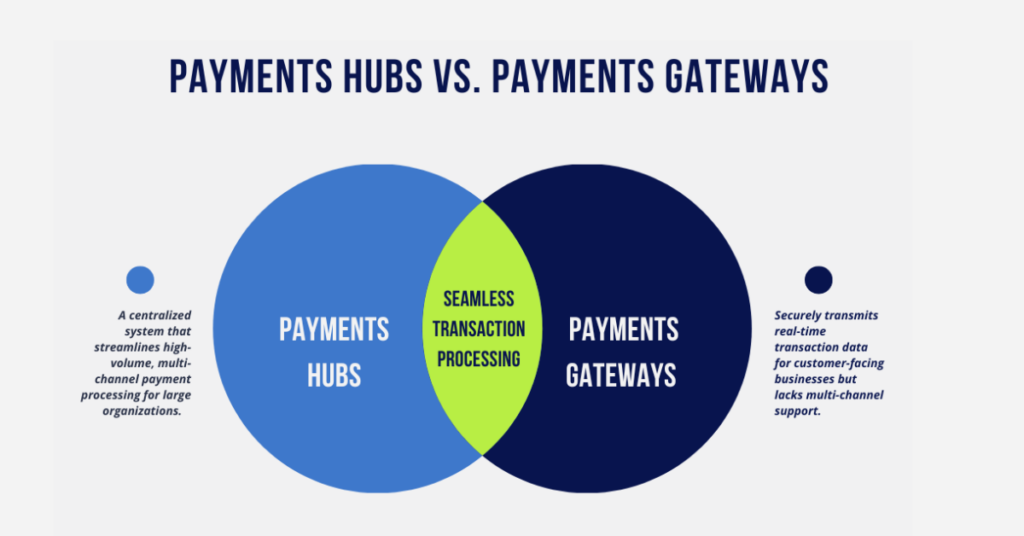

Key Takeaways1. Centralized vs. Direct: Payments hubs manage various payment types across channels; payments gateways focus on real-time customer transactions. 2. Business Fit: Use a hub for complex needs or a gateway for secure, direct sales. 3. Efficiency & Security: Both offer streamlined, secure processing but suit different business needs. |

Payments hubs and payments gateways are two essential components in the digital payment ecosystem, each serving distinct purposes. Understanding the differences can help organizations choose the right solution based on their needs, transaction volume, and user base.

What Are Payments Hubs?

A payments hub is a centralized infrastructure that lets you manage multiple payment types and channels in one unified system. Often used by financial institutions and large enterprises, payments hubs are built to handle complex, high-volume transactions seamlessly across various channels. An example of this would be your bank or credit union using a payments hub to handle sending, receiving, and orchestrating transactions across various payments rails. By implementing a payments hub, you gain an efficient, streamlined approach to processing different payment types, enabling consistency and adaptability as your organization’s payment needs evolve.

What Are Payments Gateways?

A payments gateway is a solution designed to transmit payment information during real-time transactions securely. Commonly used by e-commerce sites and retailers, a payments gateway enables smooth, secure communication between you, the merchant, and your payment processor. It’s ideal if your business requires quick, customer-facing transaction authorization. As an example, your favorite online retailer would use a payments gateway to accept payments. However, unlike payments hubs, gateways may not support multi-channel capabilities for managing diverse payment types.

In summary, payments hubs are ideal for larger, complex organizations such as banks, credit unions, and payment processors needing a centralized system for handling various payment types. Payments gateways cater to businesses focused on secure, real-time customer transactions such as e-commerce businesses, SMBs, and online merchants. Learn more about payments hubs in The Payments Hub Explained: Alacriti’s Unique Definition and How it Differs.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com