Payments hubs have become a key part of the payments modernization conversation. As financial institutions face increasing pressure to streamline payment operations, a payments hub offers a centralized approach for managing multiple payment rails, including faster payments, real-time payments, and traditional methods like ACH and wire transfers. During a call with Alacriti and Datos Insights, Datos Insights shared research regarding the growing adoption of payments hubs and the significant investment flowing into these solutions.

What is a Payments Hub?

According to Datos Insights, “A payment hub is a centralized platform acting as the nucleus for processing and managing various types of payments across a financial institution. It acts as a single point of integration for multiple payment channels, types, and systems, enabling banks to streamline their payment operations, reduce complexity, and enhance efficiency. In essence, a payment hub consolidates disparate payment processes into a unified, coherent system, allowing for greater visibility, control, and standardization across the entire payment transaction and payment account life cycle. It makes it easier for banks to create a single view of the customer across all payment types, which is particularly valuable in servicing large commercial clients.”

One of the major takeaways from the call was the continued rise in investment in payments technology across both commercial and retail banking sectors. Erika Baumann, Director at Datos Insights, emphasized that “banks are not only investing, but investment continues to get more aggressive across both sectors.” While only 6% of banks will be limiting investment in payment technology, 92% of banks will be increasing their investment even more in the next 12-24 months. This observation aligns with data showing that no banks plan to decrease their investment in payments modernization in the coming years, further highlighting the importance of these initiatives.

Are Banks Adopting Payments Hubs?

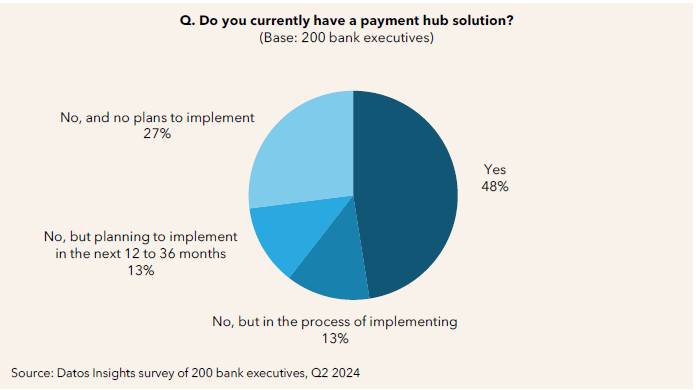

Yes! Financial institutions are increasingly seeing the value of payments hubs. Sixty percent of surveyed banks have already implemented some type of payments hub or are in the process of doing so. This is a prominent trend among larger institutions—98% of banks with assets over $100 billion have already adopted a payments hub solution.

Payments Hub Implementation: Key Challenges and Opportunities

The implementation of payments hubs is not without its challenges. One of the most frequently cited issues, according to Baumann, is the struggle to consolidate payment systems into a single view for clients. Many financial institutions have invested in partial solutions that address specific payment types but fail to provide a comprehensive view across all payment methods. This incomplete integration has led to operational inefficiencies and client dissatisfaction. As Baumann noted, even “98% of larger banks that say they already have a payments hub solution still struggle to provide a single, consolidated view of all payments to their clients.”

The size of the financial institution plays a significant role in how payments hubs are adopted. According to Whitney Sale, Senior Analyst at Datos Insights, the larger institutions tend to focus more on legacy payment systems, while smaller and mid-tier banks are prioritizing connectivity solutions over full-scale hubs. Sale explained that for many smaller banks, “they’re not looking for a total hub solution; they’re looking for connectivity,” which reflects their desire for modernization without the complexity and cost associated with full-scale hub implementations.

Why Payments Hubs are Critical

Despite the challenges, the move towards payments hubs remains crucial for financial institutions of all sizes. A well-implemented hub can significantly reduce operational redundancies, enhance client experiences, and improve the institution’s ability to offer real-time and faster payments. Baumann pointed out that vendors who can support financial institutions in overcoming legacy infrastructure challenges are more likely to gain new business. “Banks need help getting through these processes, and vendors who can offer that expertise will be able to grow their market share,” Baumann remarked.

This increased reliance on third-party vendors marks a significant shift in the industry. While larger banks once believed they could manage their payments modernization internally, they now recognize the need for external expertise. As Mark Majeske, SVP of Faster Payments at Alacriti, noted during the call, “Even the largest banks are saying, ‘I’m going to need some help.’”

The Path Forward

Payments hubs are clearly here to stay, but their success hinges on strategic investments and partnerships. Financial institutions must continue to prioritize modernization efforts while seeking vendors who can offer both technology and expertise to ensure a smooth transition. Here is how Alacriti is different:

- Multi-rail payment orchestration: A seamless process from initiation through clearing and settlement, with centralized control/configuration and the ability to add new payment rails/networks and integrate with existing banking systems.

- Unified API interface: Flexible integration framework for a single point of integration across payment channels.

- Centralized operations and reporting: Unified exception management functions are streamlined through a single agent interface.

- Data-powered optimization: Services that reduce costs.

The conversation during the Datos Insights call revealed a growing awareness of the importance of aligning payment infrastructure with future demands, making payments hubs a cornerstone of modernization strategies across the banking sector.

To see Alacriti’s payments hub in action, watch the BAI-hosted webinar, Payments Hub: Automation for the Future.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with ACH, Wire, TCH’s RTP® network, Visa Direct, and the FedNow® Service, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com