*Originally submitted by Mercator Advisory Group

Payment products are the connective tissue of financial institutions, serving as a major source of core revenue. But what are the business and technology priorities and market dynamics that drive this array of payment services? To answer that question and more, Alacriti sponsored a Mercator Advisory Report titled Payments Infrastructure Outlook: Real-Time Payments Take the Lead.

For the report, Mercator Advisory Group surveyed 100 senior-level bankers using an online executive questionnaire designed in collaboration with Alacriti; 19% of respondents represented community banks or credit unions. The report provided insight into the opinions toward payments modernization held by senior leadership at banks and credit unions.

Some of the key points are highlighted below.

FIs recognize payments as a valuable revenue stream

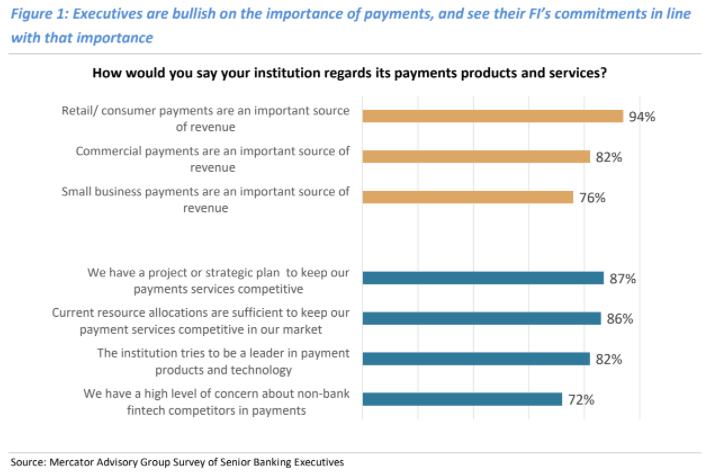

Most executives surveyed for the report agree that consumer, small business, and commercial payments are important revenue streams for their businesses. Most also agree that their FI is working to be a leader in payments products and technology. A breakdown of the data around how executives view their institution’s payments products and services can be seen in the chart below:

The pandemic environment for the past year has been particularly favorable to payments modernization, with 79% of surveyed executives indicating that payments technology modernization efforts have been boosted by the pandemic. Additionally, the advent of real-time and faster payments is similarly turning up the urgency of infrastructure modernization.

This urgency corresponds with rising consumer expectations for new services, which will translate into new revenue streams for financial institutions. For example, most executives (87%) agree that real-time payments will drive new revenue streams and that they are already receiving client requests for this service.

But how are these modernization efforts being accomplished?

The role of the cloud in IT strategy modernization

As financial institutions update payments processes, rapidly evolving business products and business lines add complexity to IT infrastructure. Even as executives are acknowledging the importance of payments modernization, payment operation simplification is a dominant approach at 66% of financial institutions.

Cloud-based infrastructure is the overwhelming preference for achieving this simplification due to advantages including a superior end-user experience, quicker speed to market, pay-as-we-go, and implement-as-we-go possibilities. Overall, 90% of executives agreed or strongly agreed that cloud-based infrastructure is their current preference for payments IT infrastructure; 91% agreed that cloud-based infrastructure is their current preference for overall IT infrastructure.

Even so, previous sunk costs in proprietary and licensed IT can reduce interest in cloud implementation. Ultimately, cloud implementation will mainly lie in the hands of outsourcing partners.

Meeting the real-time need for real-time payments

Moving forward, real-time payments will be fundamental in payments technology modernization efforts. When asked about the future of real-time payments at their institution, the top two major use cases for real-time payments listed by executives are immediate payroll payment or gig economy payments (73%) and account-to-account transfers (71%).

As for how they anticipate real-time payments solutions to integrate at their institutions, executives overwhelmingly anticipate doing so through core providers and other third-party providers, building upon the key role of outsourcers in payments modernization. Ultimately, real-time payments are on the horizon and are a compelling reason for financial institutions to modernize their infrastructure now.

The takeaway

The Mercator Advisory Group report sponsored by Alacriti digs significantly deeper into the trends and strategic implications regarding payments modernization, including:

- Banking executive attitudes toward the centrality of payments businesses and technological modernization efforts.

- Perceptions toward simplifying payment operations and utilizing a cloud-based IT approach.

- Institutional outlooks and priorities on real-time and faster payments.

- The future of real-time payments and anticipated use cases across financial institutions.

- The critical role third parties will play in real-time payments integration.

Interested in learning more? Click here and fill out the form to access the Mercator Advisory Group research brief sponsored by Alacriti, Payments Infrastructure Outlook: Real-Time Payments Take the Lead.