Today’s consumers are more connected and informed than ever before. They expect products and services to match the mobility and flexibility of their lifestyles. So why should their bill payments be any different?

Truth is, consumers are always looking for the newest ways to manage and pay their bills—and in the post-COVID-19 world, new ways to conduct business with as little contact as possible have jumped in popularity. Providing solutions that are forward-thinking and customer-focused can help businesses establish a competitive advantage. An electronic bill presentment and payment (EBPP) solution can help your business get started on this journey.

What is EBPP?

An EBPP solution integrates seamlessly into existing systems to present bills electronically and accept payments from customers. EBPP helps bridge the gap between digital payments (web, Pay by Text, intelligent personal assistants, etc.) and payments generated from more traditional channels (agent, IVR, kiosk, etc.). In addition, an EBPP solution supports multiple payment methods (ACH, credit cards, debit cards, cash, etc.) while giving customers the ability to choose from a variety of payment options (recurring payments, payment plans, AutoPay, etc.).

What are the benefits of EBPP for businesses?

Bill payments have a direct impact on a business’s bottom line, making it imperative to deliver a user experience that works for all customers. The personalization that an EBPP solution can provide makes it easier for businesses to offer a user-centric experience no matter how customers choose to pay.

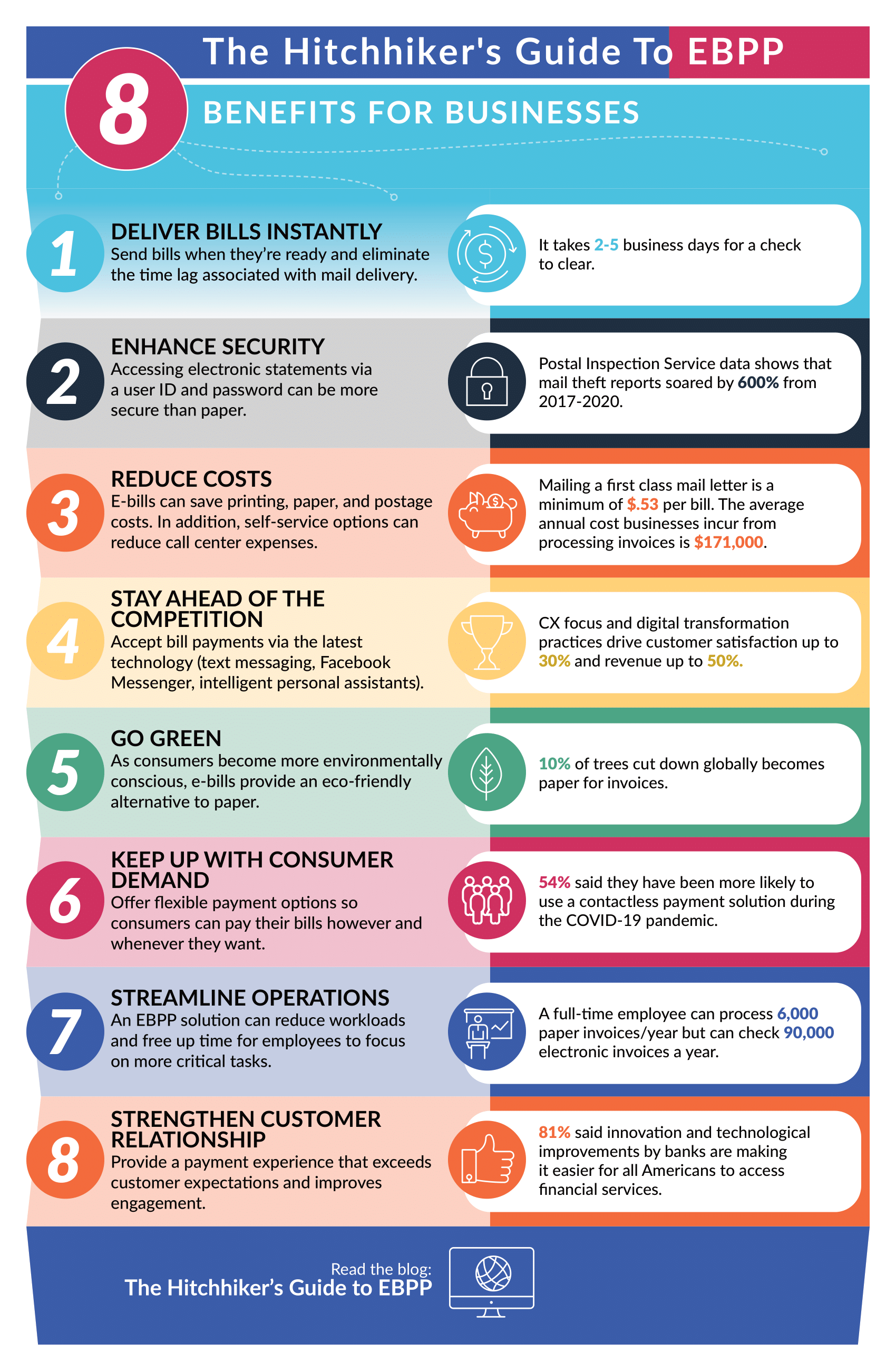

Here are some of the benefits of EBPP for businesses:

- Deliver Bills Instantly – Send bills as soon as they’re ready and eliminate the time lag associated with mail delivery. Electronic bills can also help encourage customers to accelerate the timing of their payments.

- Reduce Costs – Printing and mailing paper bills costs both time and money. Moving customers to e-bills can reduce the expenditures needed for printing, fulfilling, and sending hard copy statements as well as fulfill consumer demands for contactless payments. In addition, an EBPP solution can give customers the tools to self-service online. This can free up time for call center staff to focus on more strategic priorities.

- Go Green – Today’s consumers are more environmentally aware and welcome opportunities to be eco-friendly. E-bills allow your business to provide choice, meet customer needs, reduce environmental impact, and control costs.

- Strengthen Customer Relationships – A happy customer is a loyal customer. Providing an intuitive and easy-to-use bill payment experience can help strengthen your business’s relationships with your customers.

Read the complete list of benefits in our infographic.

The Bottom Line: Billing and payments are a critical component of the customer journey. Providing a wide range of electronic payment options to your customers can help your business meet their needs while strengthening customer relationships, reducing costs, and streamlining operations.

*Updated from a blog originally published September 17, 2019.

Learn more about the basics of EBPP.