Product Insights: Could Your Payments Back Office Be Better?

Even if you offer comprehensive and easy-to-use self-service payment options, there will always be a need to provide customer service and take customer payments over the phone.

The problem is that, all too often, the back-office payment functions in payment platforms are a bit of an afterthought, and may not be easy or efficient to use. However, that is not the case with Orbipay EBPP’s Payment Center.

Many Different Search Criteria

First up, let’s start with the most basic function—looking up a customer, account, or transaction.

Many solutions will limit the search criteria you can use to specific data points, such as an account or confirmation number. But what if your CSR doesn’t have that data, the caller doesn’t know it, or you want to pull back all customers and accounts that share common data, for example, an email address?

EBPP’s lookup is designed to allow you to utilize multiple different search criteria for a lookup, individually or in combination:

This includes scenarios where a third party calls you to query a debit to their bank or card account but has little to no information about your customer. In these cases, you can use the bank or card account number for lookup, or the unique transaction reference ID that was submitted with the bank or card debit.

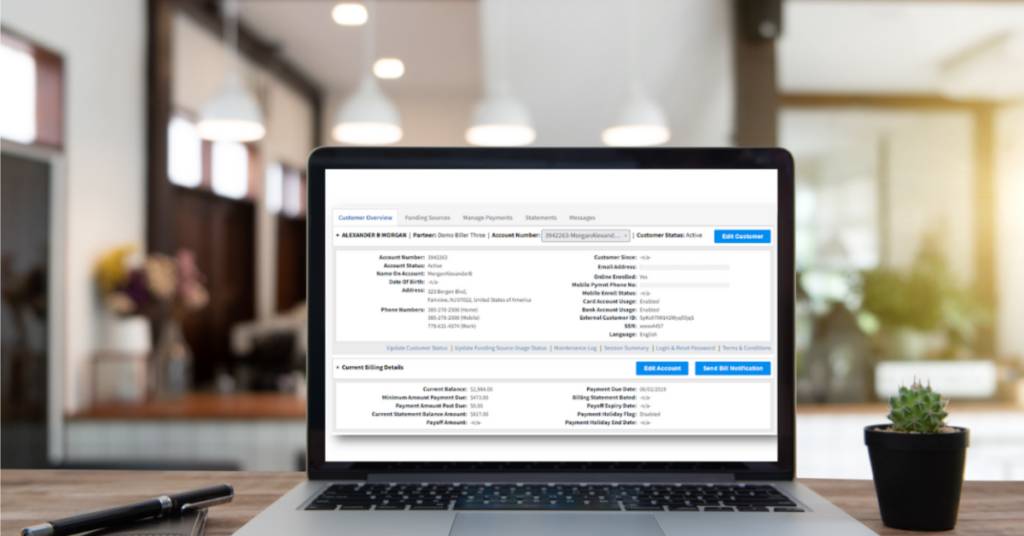

Comprehensive Customer Overview

Ok, so now you’ve successfully located a customer account profile. But how easy is it to achieve what you need to do?

In many solutions, in order to answer basic questions from customers, you will have to navigate multiple screens and tabs. This is not the case in EBPP where the Customer Overview has all the data you need to answer most basic questions

At the top of the page, you’ll find the customer’s demographic information, account status indicators, customer management tools, audit logs, and details of their current bill:

You can also switch to any other accounts linked to that customer profile, and send an actionable Bill Notification, allowing customers to make frictionless payments whilst they are on the phone with you, or later on, at their leisure.

You can also access the Funding Sources and Manage Payments pages from the top navigation. However, for customer service requests, in most cases, you will not need to access those functions.

Lower down the page, you have access to scheduled payments, processed payments, payment enrollments, and processed refunds:

You now have enough data to answer basic customer questions, with the option to drill down to more details. Along with this, you will have options to edit or cancel scheduled payments and initiate electronic refunds.

You will also be able to initiate payments through the payment channels you have enabled, with three options available:

- Call Center Agent: Supports phone payments in your call center.

- Collections Agent: Supports phone payments for accounts in collections.

- Front Office Agent: Supports face-to-face payments in your offices or branches, including support for cash, checks, and point-of-sale devices.

Quick & Easy Payments

Next, you will need to take, or set up payments, for the customer or person who has called in. This process needs to be quick and easy, as CSR time is a hard cost in call center operations.

Many solutions fall short in this area, especially if a new payment method needs to be added, or the user interface is not optimized for payments with minimal keystrokes or clicks.

EBPP overcomes these challenges with a user-friendly interface that is designed to make payments processes as efficient as possible, for both CSRs and customers:

This includes:

- Radio buttons rather than dropdowns for making selections.

- Support for multiple payment types on one page.

- Ability to add new payment methods directly within the make payment page.

- Support for payments from third parties by allowing entry of their email for email receipts.

- Dynamically generated TEL authorization wording to ensure improved compliance.

In Conclusion

Orbipay EBBP’s back-office functions are designed to enhance and streamline your operations, providing you with minimal and efficient features for customer service, payment creation, and management.

To learn more about how to use Orbipay EBPP, please read Using CSR Bill Notifications To Streamline Your Phone Payments.

Alacriti’s Orbipay EBPP is a customizable electronic billing and payments solution for businesses and financial institutions of all sizes. Orbipay EBPP offers convenient and flexible choices that include all the payment channels, payment methods, and payment options expected from a modern digital bill pay experience. For more information, please contact us at info@alacriti.com.