With over 200 credit unions now on the RTP® network, credit unions are figuring out how to integrate these solutions to enhance their member relationships and improve their offerings. So, how can instant payments drive growth, deepen relationships with members and small businesses, and generate new revenue streams?

In this exclusive Callahan-hosted panel discussion, speakers Keith Gray, Vice President of Strategic Partnerships at The Clearing House, and Mark Majeske, SVP of Faster Payments at Alacriti discuss how credit unions can navigate instant payments, focusing on practical use cases, member engagement, and growth opportunities.

Key topics include:

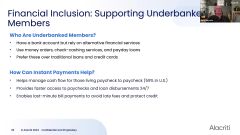

- How instant payments can support financial inclusion by serving underbanked members.

- Specific use cases that credit unions care about, such as loan funding and account verification.

- How real-time payments can be used to drive more deposits and increase loan origination.

- The potential of Request for Payment (RfP).

- Key factors that contribute to the ROI of instant payments for credit unions.

- Ways your small business members can leverage real-time payments to better serve their needs.

Opportunities in Digital Banking: Leveraging Instant Payments

With 59% of US consumers living paycheck to paycheck, banks can enhance services by capitalizing on digital payment trends.

Instant Payments: Revolutionizing Financial Transactions with Real-Time Processing

Boosting Credit Union Revenue through Enhanced Payment Services

Seamless Transition to RTP for Financial Institutions

Expanding Financial Services: From Safe Loan Disbursements to Versatile Transactions

RTP: Revolutionizing Small Business Transactions

Real-Time Payments: Transforming Business Operations

East Coast Financial Institution's Journey with Instant Payments

How Instant Payments Empower the Underbanked

Enhancing Control and Efficiency with Request for Payment

Full Video

Related Resources

Speakers

Mark Majeske

SVP Faster Payments, AlacritiAs Senior Vice President of Faster Payments at Alacriti, Mark leads the overall corporate faster payments strategy and product development of the Orbipay Payments Hub. Mark also currently serves in the Faster Payments Council Board Advisory Group. Previously, Mark led product development for the RTP® network, the FedNow® Service, and Zelle® at FIS. In addition, Mark was part of the team that designed, developed, and launched the RTP network at The Clearing House.

Keith Gray

Vice President, Strategic Partnerships, The Clearing HouseKeith Gray is a Vice President of The Clearing House with responsibility for RTP® Network Strategic Partnerships. These partnerships are critical to the success of RTP, in that many banks and credit unions will leverage RTP through a trusted technology partner. Mr. Gray works with these partners to facilitate the launching and supporting of their RTP initiatives. During his 20–year career, Mr. Gray has worked extensively with financial institutions of all sizes, as well as financial technology companies on emerging payments initiatives, mobile solutions, and online banking applications. He worked with multiple early-stage organizations bringing new products to market.